PayPal Holdings Inc - Climate Change 2023

C0. Introduction

C0.1

(C0.1) Give a general description and introduction to your organization.

PayPal Holdings, Inc. (PayPal) is a leading technology platform headquartered in the United States that enables digital payments and simplifies commerce experiences on

behalf of merchants and consumers worldwide. For more than 20 years, we have remained focused on our mission to make financial services and commerce more affordable,

convenient and secure for all.

We are committed to democratizing financial services to help improve the financial health of individuals and to increase economic opportunity for entrepreneurs and

businesses of all sizes around the world. Our goal is to enable our merchants and consumers to manage and move their money anywhere in the world in the markets we

serve, anytime, on any platform, and using any device when sending payments or getting paid. We operate a global, two-sided network at scale that connects merchants and

consumers with 435 million active accounts across more than 200 markets as of December 31, 2022.

PayPal’s payment solutions enable our customers to connect, transact, and send and receive payments, whether they are online or in person. We provide proprietary

payment solutions accepted by merchants that enable the completion of payments on our payments platform on behalf of our customers. We offer our customers the flexibility

to use their PayPal or Venmo accounts to purchase and receive payments for goods and services, as well as the ability to transfer and withdraw funds. We enable consumers

to exchange funds more safely with merchants using a variety of funding sources, which may include a bank account, a PayPal or Venmo account balance, PayPal and

Venmo branded credit products including our installment products, a credit card, a debit card, certain cryptocurrencies, or other stored value products such as gift cards, and

eligible rewards. Our PayPal, Venmo, and Xoom products also make it safer and simpler for friends and family to transfer funds to each other. We offer merchants an end-to-

end payments solution that provides authorization and settlement capabilities, as well as instant access to funds and payouts. We also help merchants connect with their

customers, process exchanges and returns, and manage risk. We help reduce the friction typically involved in cross-border commerce by offering consumers a simple

payment experience and by enabling merchants to extend their reach to consumers in the global markets in which our services are available.

C0.2

(C0.2) State the start and end date of the year for which you are reporting data and indicate whether you will be providing emissions data for past reporting

years.

Reporting year

Start date

January 1 2022

End date

December 31 2022

Indicate if you are providing emissions data for past reporting years

No

Select the number of past reporting years you will be providing Scope 1 emissions data for

<Not Applicable>

Select the number of past reporting years you will be providing Scope 2 emissions data for

<Not Applicable>

Select the number of past reporting years you will be providing Scope 3 emissions data for

<Not Applicable>

C0.3

CDP Page of 631

(C0.3) Select the countries/areas in which you operate.

Australia

Brazil

Canada

China

France

Germany

Guatemala

Hong Kong SAR, China

India

Ireland

Israel

Italy

Japan

Luxembourg

Mexico

Philippines

Poland

Russian Federation

Singapore

Spain

Sweden

United Kingdom of Great Britain and Northern Ireland

United States of America

C0.4

(C0.4) Select the currency used for all financial information disclosed throughout your response.

USD

C0.5

(C0.5) Select the option that describes the reporting boundary for which climate-related impacts on your business are being reported. Note that this option should

align with your chosen approach for consolidating your GHG inventory.

Operational control

C0.8

(C0.8) Does your organization have an ISIN code or another unique identifier (e.g., Ticker, CUSIP, etc.)?

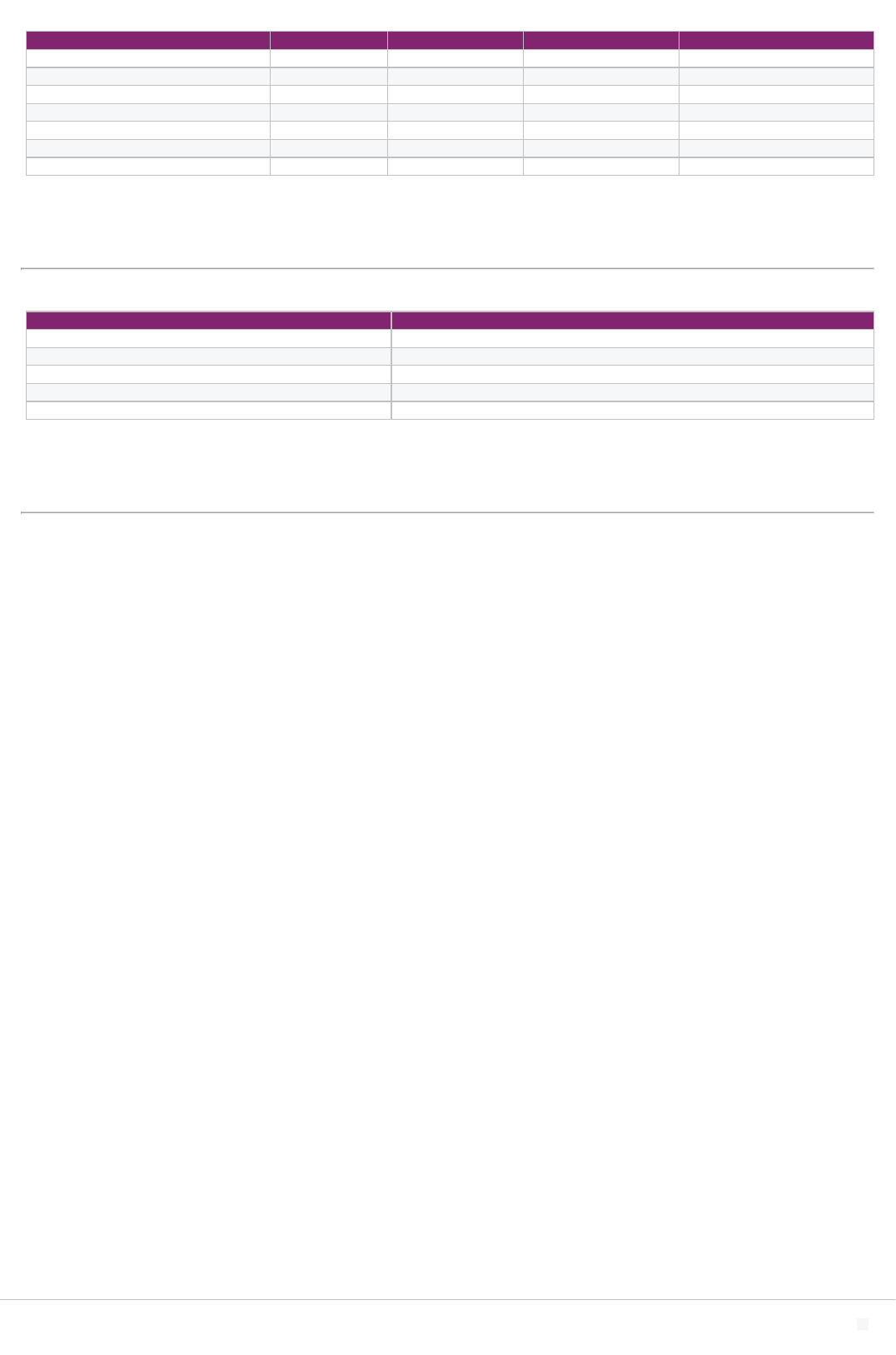

Indicate whether you are able to provide a unique identifier for your organization Provide your unique identifier

Yes, a Ticker symbol PYPL

C1. Governance

C1.1

(C1.1) Is there board-level oversight of climate-related issues within your organization?

Yes

C1.1a

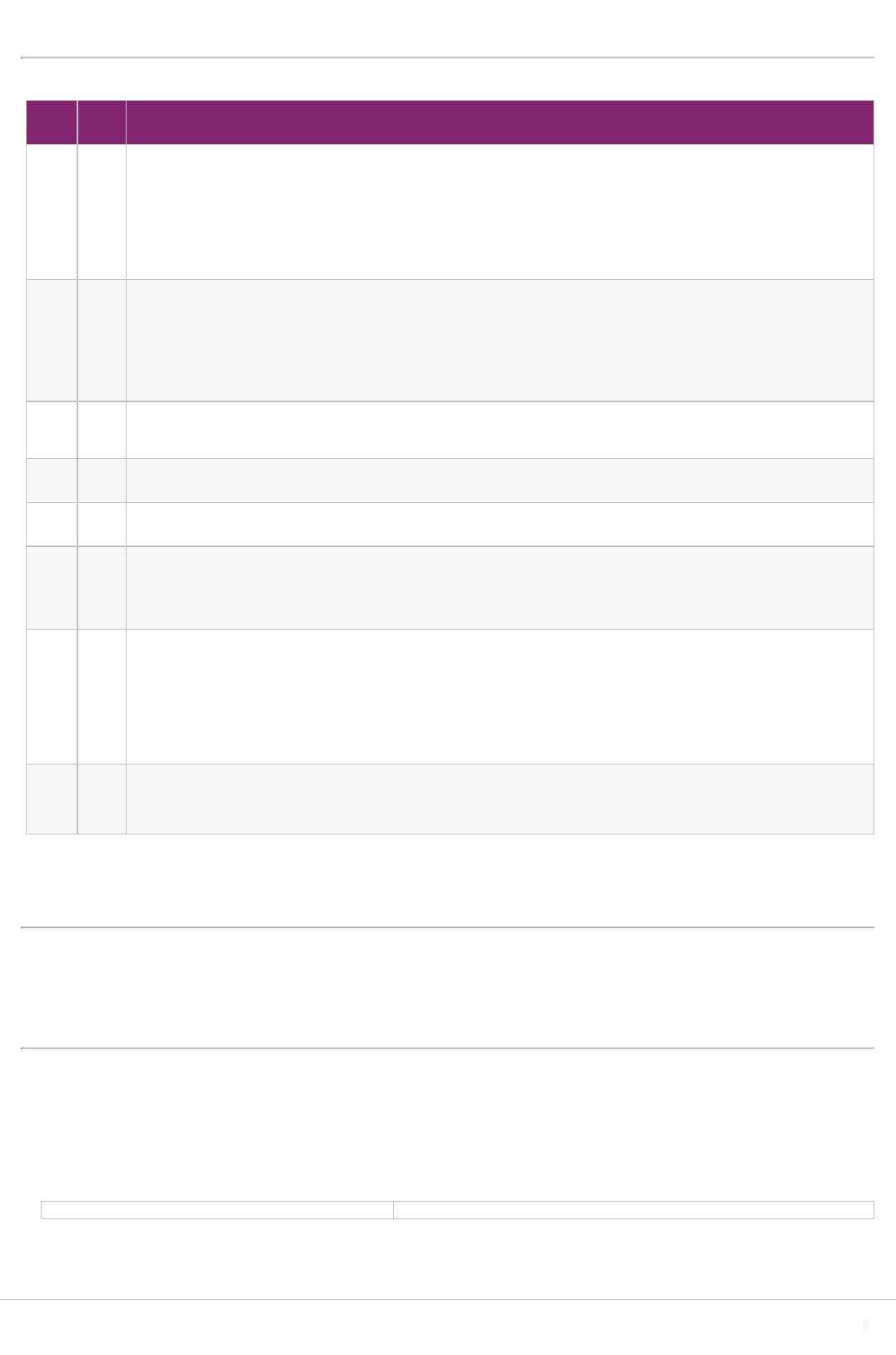

(C1.1a) Identify the position(s) (do not include any names) of the individual(s) on the board with responsibility for climate-related issues.

Position of

individual

or

committee

Responsibilities for climate-related issues

Board-level

committee

As specified in its publicly available Charter, the Corporate Governance and Nominating Committee of PayPal’s Board of Directors provides oversight of environmental, social and governance (ESG)

matters, including climate-related issues. The Committee’s responsibilities include reviewing progress in developing and implementing strategies for managing environmental issues, including

management of climate-related risks and opportunities, as well as overseeing the establishment of and progress toward fulfilling public environmental sustainability commitments.

CDP Page of 632

C1.1b

(C1.1b) Provide further details on the board’s oversight of climate-related issues.

Frequency

with which

climate-

related

issues are a

scheduled

agenda item

Governance

mechanisms

into which

climate-

related issues

are integrated

Scope of

board-

level

oversight

Please explain

Scheduled –

some

meetings

Reviewing and

guiding

strategy

Overseeing

and guiding the

development of

a transition

plan

Monitoring the

implementation

of a transition

plan

Overseeing the

setting of

corporate

targets

Monitoring

progress

towards

corporate

targets

Reviewing and

guiding the risk

management

process

<Not

Applicabl

e>

PayPal leadership provides quarterly updates to the Board’s Corporate Governance and Nominating Committee on ESG-related matters, including specific climate-related

issues. Pertinent updates are then shared with the full Board. This includes regular reporting on enterprise-wide climate targets, future strategies, stakeholder

engagements, progress on climate-related targets, and other key implementation updates. For example, in 2022, PayPal leadership briefed the Committee on climate-

related agenda items including our annual emissions reporting, progress on our science-based climate targets and our renewable energy goal for our data centers

(achieving 100% since 2021), and our climate equity and resilience strategy and initiatives. We also discussed the emerging and evolving mandatory climate disclosure

regulations globally, stakeholder expectations, and our transition planning for PayPal to reach net-zero emissions by 2040.

C1.1d

(C1.1d) Does your organization have at least one board member with competence on climate-related issues?

Board

member(s)

have

competence

on climate-

related

issues

Criteria used to assess competence of board member(s) on climate-related issues Primary

reason for

no board-

level

competence

on climate-

related

issues

Explain why your

organization does not have

at least one board member

with competence on climate-

related issues and any plans

to address board-level

competence in the future

Row

1

Yes The Corporate Governance and Nominating Committee of PayPal’s Board of Directors annually reviews with the Board the core skills,

qualifications, experience, expertise and attributes of Board nominees that we consider most relevant in light of our current business strategy and

structure. Our Board skills matrix included in our 2023 Proxy Statement includes an assessment of ESG-related skills and expertise for each of our

Board directors. This assessment included consideration of each director’s expertise and experience with respect to environmental risks and

opportunities, including through executive experience, other public company board positions, and key qualifications. For example, PayPal’s

Corporate Governance and Nominating Committee Chair also serves as President and CEO of the American Red Cross and as a director of DTE

Energy.

<Not

Applicable>

<Not Applicable>

C1.2

CDP Page of 633

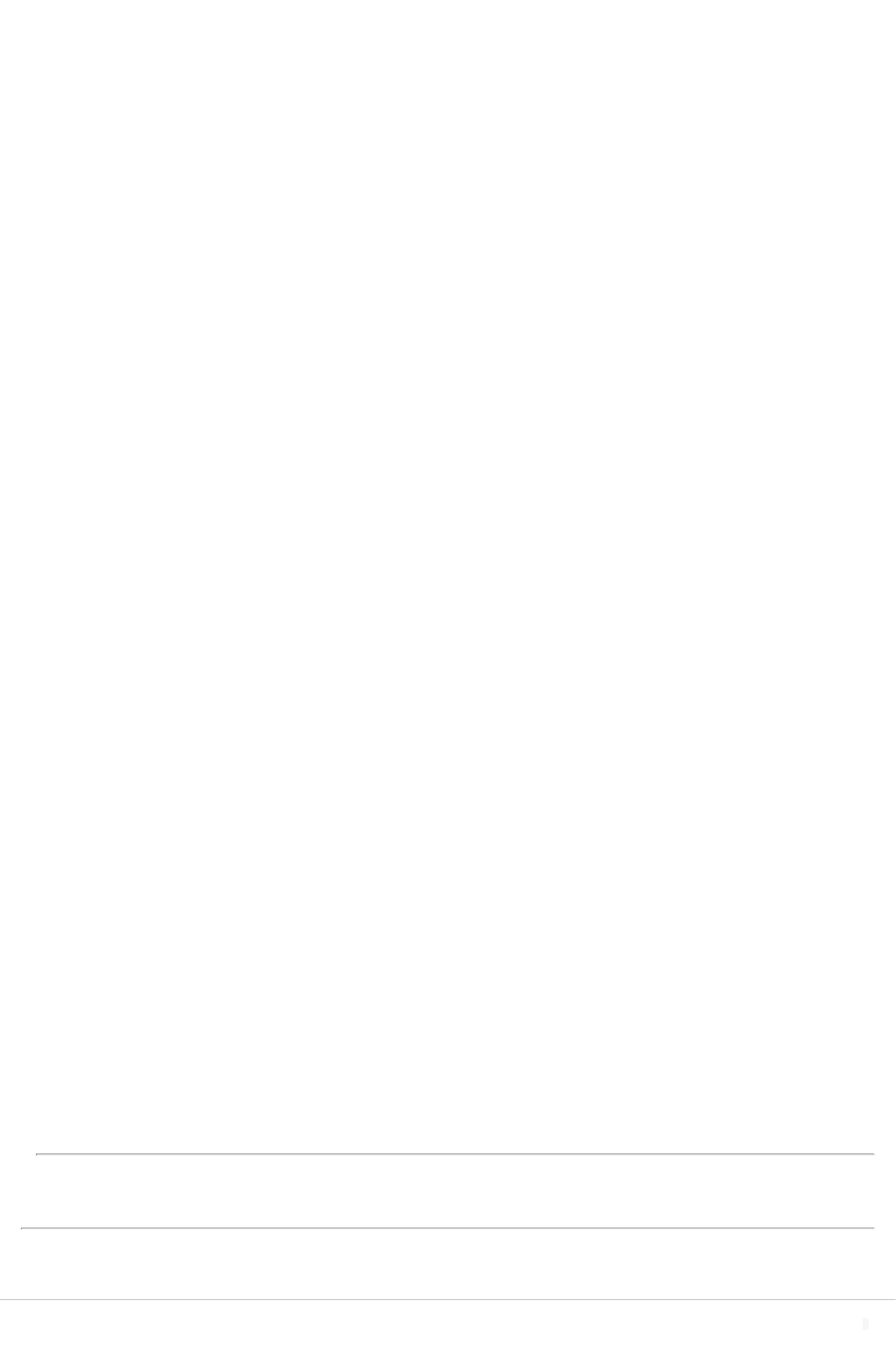

(C1.2) Provide the highest management-level position(s) or committee(s) with responsibility for climate-related issues.

Position or committee

Other C-Suite Officer, please specify (Chief Corporate Affairs Officer)

Climate-related responsibilities of this position

Managing annual budgets for climate mitigation activities

Developing a climate transition plan

Implementing a climate transition plan

Setting climate-related corporate targets

Monitoring progress against climate-related corporate targets

Managing public policy engagement that may impact the climate

Managing value chain engagement on climate-related issues

Assessing climate-related risks and opportunities

Managing climate-related risks and opportunities

Coverage of responsibilities

<Not Applicable>

Reporting line

CEO reporting line

Frequency of reporting to the board on climate-related issues via this reporting line

Quarterly

Please explain

PayPal executives, including our Chief Corporate Affairs Officer and Chief Financial Officer, lead the management of PayPal’s ESG strategy and program, including climate-

related risks and opportunities in close collaboration with other senior executives such as our EVP of People and Sourcing, Chief Information Officer and Chief Risk and

Compliance Officer. These senior leaders and their teams provide regular updates to the Board and associated Committees on climate- and ESG-related topics, when

appropriate.

C1.3

(C1.3) Do you provide incentives for the management of climate-related issues, including the attainment of targets?

Provide incentives for the management of climate-related issues Comment

Row 1 Yes

C1.3a

(C1.3a) Provide further details on the incentives provided for the management of climate-related issues (do not include the names of individuals).

Entitled to incentive

Business unit manager

Type of incentive

Monetary reward

Incentive(s)

Bonus - % of salary

Performance indicator(s)

Progress towards a climate-related target

Incentive plan(s) this incentive is linked to

Short-Term Incentive Plan

Further details of incentive(s)

All non-executive employees have an opportunity to earn annual incentive compensation based on company performance and individual performance. 50% of awards to

employees under the Annual Incentive Plan (AIP) is based on company performance, with the remaining 50% based on individual performance. Each employee is

assessed on their individual contribution ranging from 0% to 200%. This assessment includes annual performance on targets, expectations, and objectives based on the

individual’s team, function, and role.

Explain how this incentive contributes to the implementation of your organization’s climate commitments and/or climate transition plan

Members of our infrastructure and data center organization have individual performance objectives related to our goal of reaching 100% renewable energy across our data

centers by 2023. Performance against these objectives is then considered in their annual performance evaluation, which factors into the individual performance component

of their Annual Incentive Plan (AIP) award.

C2. Risks and opportunities

C2.1

CDP Page of 634

(C2.1) Does your organization have a process for identifying, assessing, and responding to climate-related risks and opportunities?

Yes

C2.1a

(C2.1a) How does your organization define short-, medium- and long-term time horizons?

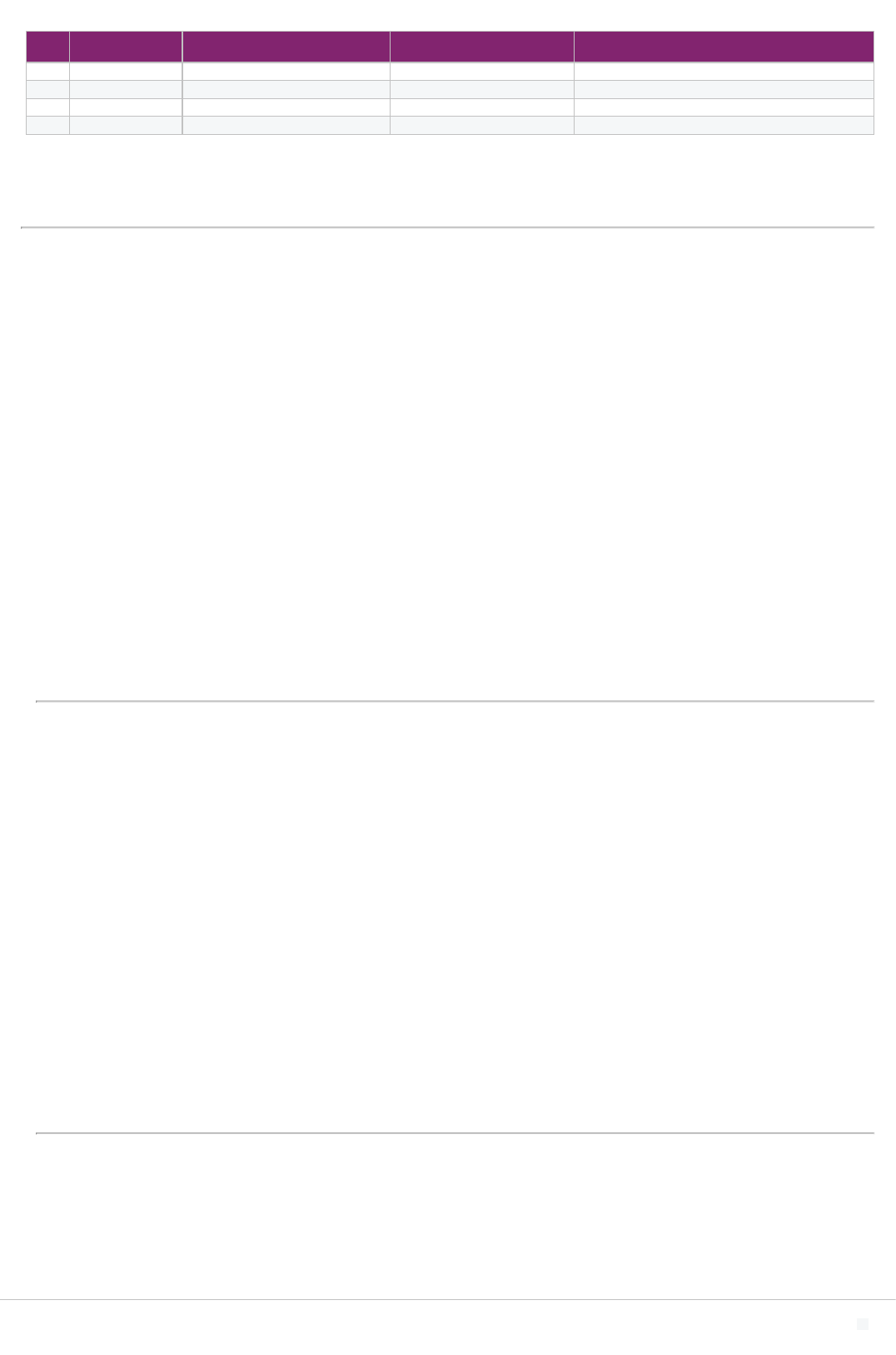

From (years) To (years) Comment

Short-term 0 3

Medium-term 3 5

Long-term 5 10

C2.1b

(C2.1b) How does your organization define substantive financial or strategic impact on your business?

PayPal uses a number of methods to define substantive financial or strategic impact when considering risks and opportunities, including those related to climate change,

across our global business. For example, we consider potential qualitative and quantitative impacts of climate change on our financial condition and results of operations,

including impacts to our balance sheet and income statement. Quantitatively, we begin our evaluation using our SOX financial statement materiality threshold, which is

calculated annually based on the average of our prior year actual and current year forecasted GAAP operating income. However, we also recognize the importance of

intangible value and consider strategic impacts related to brand value, reputational risk, future business opportunities, and investor and customer expectations, among others.

When reviewing potential risks and opportunities, senior leaders at PayPal evaluate a broad set of data points, including those described above, and consult with internal

experts to estimate the magnitude of the impact and take appropriate responsive actions.

C2.2

(C2.2) Describe your process(es) for identifying, assessing and responding to climate-related risks and opportunities.

Value chain stage(s) covered

Direct operations

Upstream

Downstream

Risk management process

Integrated into multi-disciplinary company-wide risk management process

Frequency of assessment

Annually

Time horizon(s) covered

Short-term

Medium-term

Long-term

Description of process

PayPal applies an integrated and multi-disciplinary company-wide approach to enterprise risk management using the Three Lines of Defense model, which includes

management, oversight, and independent assurance. Our Enterprise Risk and Compliance Management Program sets PayPal’s programmatic approach to identifying,

measuring, managing, monitoring, and reporting key short- (0-3 years), medium- (3-5 years), and long-term (5-10 years) risks facing our company, including to our direct

operations, upstream, and downstream activities. We use established risk management committees to oversee the implementation and execution of our program, including

the Enterprise Risk Management Committee. The Enterprise Risk Management Committee is the highest-level risk management committee and is co-chaired by PayPal’s

Chief Risk and Compliance Officer and Chief Enterprise Services Officer. They regularly review and discuss the overall effectiveness of the Enterprise Risk and Compliance

Management Program with the Board of Directors and its Audit, Risk, and Compliance Committee. Beginning in 2022, climate-related risks have been incorporated to the

multi-disciplinary company-wide enterprise risk management process via their inclusion in the enterprise risk taxonomy which is approved by the Audit, Risk, and

Compliance Committee of the Board.

To further reinforce the linkages between our governance and risk management programs, we regularly report on emerging ESG risks that affect PayPal’s business,

including climate-related risks, to a subcommittee of the Enterprise Risk Management Committee as part of an annual ESG risk review. This process is overseen by the

ESG Steering Committee consisting of senior leaders across PayPal who provide strategic direction and leadership for the continued development of our ESG strategy. The

ESG Steering Committee also oversees program implementation through the ESG and Environmental Working Groups and partners with functions across PayPal on the

management of climate-related risks. PayPal’s Environmental Working Group, a multi-disciplinary team of employees with responsibility for implementing, developing, and

managing PayPal’s environmental matters, conducts an annual review of environmental risks and opportunities, including those related to climate change, and reports the

results to members of the ESG Steering Committee for appropriate consideration.

We annually review our ESG significance map and conduct periodic ESG significance and prioritization assessments of non-financial risks and opportunities. This work,

which includes peer benchmarking and internal and external stakeholder engagement, helps to inform the prioritization of non-financial topics relevant to PayPal, including

climate change, based on their importance to PayPal’s long term business performance.

In 2022, we began an enterprise climate risk assessment and scenario analysis using three scenarios from the Network for Greening the Financial System to evaluate

potential short-, medium- and long-term climate risks and opportunities for PayPal. Initial results identified key risks for PayPal, including physical, operational, regulatory

and reputational risk.

CDP Page of 635

C2.2a

(C2.2a) Which risk types are considered in your organization's climate-related risk assessments?

Relevance

&

inclusion

Please explain

Current

regulation

Relevant,

always

included

Renewable energy regulation and carbon pricing in the U.S. and globally is relevant to PayPal due to our commitment to achieve 100% renewable energy in our data centers by 2023 and

our Science-Based Target for operational emissions to reduce Scope 1 & Scope 2 emissions by 25% below our 2019 baseline by 2025. We prioritized reductions to our data center

emissions footprint since over 75% of our annual energy use is from these sources (77% as of 2022) and we achieved 100% renewable energy in our data centers in 2021, two years

ahead of our goal. In 2022, we maintained 100% renewable energy sourcing for our data centers and reached 90% total renewable energy use (up from 88% in 2021 and 76% in 2020).

PayPal’s Environmental Working Group monitors the state of renewable energy regulation in the U.S. as part of our renewable energy procurement strategy for our data centers.

Our membership in the Clean Energy Buyers Association helps enable us to understand renewable energy and carbon pricing regulation and regulatory risks in the U.S., where the

majority of our managed data center presence is located. The Environmental Working Group also assesses national, state, and local energy and water management and disclosure

regulations, such as the San Jose Energy and Water Benchmarking Ordinance for our corporate headquarters and the E.U. Energy Efficiency Directive for several of our European office

locations. The Environmental Working Group has implemented a process for monitoring and ensuring compliance with current regulations.

Emerging

regulation

Relevant,

always

included

In addition to leveraging the same measures described above for our climate-related risk assessment for current regulation, members of the Environmental Working Group, including

representatives from Public Affairs and Government Relations, collaborate with functions across PayPal to consider how current and emerging regulations may impact climate-related risks

and opportunities at PayPal. For example, in 2022, PayPal completed an initial climate risk assessment in Europe in accordance with new guidance on the management of climate-related

and environmental risks published by the Commission de Surveillance du Secteur Financier (Circular CSSF 21/773) to identify potential areas of risk exposure. We are working to

implement an action plan designed to enhance our governance processes and risk management procedures to address the identified risks. This work is instrumental in meeting current and

emerging regulatory obligations in Europe and will help inform climate risk assessments in other regions.

We are aware of and closely monitor the emergence of mandatory climate-related disclosure rulemaking processes, particularly in the U.S. We are broadly supportive of climate change

disclosures that provide stakeholders with consistent, comparable, and reliable information based on existing voluntary ESG and climate disclosure and accounting standards.

Technology Not

relevant,

included

We do not consider risks from technological improvements or innovations that support the transition to a lower carbon, energy-efficient economy to be relevant. As a company that

provides digital payment solutions, our business is not dependent on unproven or as-yet-undeveloped technologies to facilitate climate-related infrastructure upgrades or equipment

replacement. While businesses that focus on energy, resource extraction, transportation, or manufacturing may depend on such technologies to ensure viability and competitiveness, we

see low-carbon and climate-neutral technology as a meaningful opportunity for our business.

Legal Not

relevant,

included

We do not consider risks from climate-related litigation claims to be relevant at the current time. As a company that provides digital payment solutions, our business has a relatively small

climate impact. Our products and services do not directly contribute to climate change in a significant way, compared to companies in other sectors, such as energy, resource extraction,

transportation, or manufacturing. We are monitoring the potential for future climate-related litigation risks as our business grows and evolves.

Market Relevant,

always

included

Preliminary findings from the enterprise climate risk assessment and scenario analysis that we began in 2022 identified market risk exposures that could impact PayPal's operations. The

findings from this assessment will also be considered as we refine our risk management practices.

Reputation Relevant,

sometimes

included

Reputational risk is relevant in the short-term as we observe increased stakeholder interest, including from current and potential investors, customers, employees, and partners, in our

climate commitments and performance, as well as adherence to climate regulations. We manage the climate impacts of our business and seek to mitigate potential reputational issues. Our

Environmental Working Group coordinates closely with the Reputation Risk Management team to identify potential climate-related matters and exposures to our business. We regularly

engage stakeholders to understand and anticipate their climate-related expectations of PayPal. For example, we conduct benchmarking research, including monitoring media and social

media coverage of other companies facing climate-related reputational issues, to help stay ahead of trends and identify key learnings that may be applicable to PayPal’s climate-related

strategy.

Acute

physical

Relevant,

always

included

Physical risks may be acute, resulting from increased frequency and severity of extreme weather events, and also chronic, resulting from increases in global temperature and changes in

precipitation and weather patterns. In the medium and long term, PayPal considers acute disruptive events, such as severe weather, wildfires, and other climate-related risks, which could

impact operations at our physical locations including offices and data centers. These extreme weather conditions may cause impacts to our business, such as safety disruptions and supply

chain delays. The impacts may adversely affect worker productivity, cause us to incur additional costs to maintain, resume or rebuild operations, and lead to higher attrition.

Our Resiliency program and Safety and Security teams prepare incident response procedures for our physical locations to help inform emergency response plans in the event of potential

disasters or other crises. PayPal has implemented disaster recovery plans in the event of damage and/or business interruption, inclusive of impacts from climate-influenced disasters.

The enterprise climate risk assessment and scenario analysis that we began in 2022 will help us further understand and identify the potential impacts of acute physical climate risks on

PayPal’s business, strategy, and financial planning. The findings from this assessment will also be considered as we refine our risk management practices.

Chronic

physical

Relevant,

always

included

This risk type is relevant for PayPal given that we maintain a global presence with sites across the Americas, APAC, and EMEA regions which are vulnerable to chronic physical climate

changes. Our Environmental Working Group, in partnership with our Global Safety and Security team, is monitoring the impact of long-run climatic shifts, including the potential impacts of

water stress to our direct operations. We are exploring opportunities to further quantify risks and refine our understanding of chronic physical climate and extreme-weather related risks to

our locations. The enterprise climate risk assessment and scenario analysis that we began in 2022 will help us further understand and identify the potential impacts of chronic physical

climate risks on PayPal’s business, strategy, and financial planning. The findings from this assessment will also be considered as we refine our risk management practices.

C2.3

(C2.3) Have you identified any inherent climate-related risks with the potential to have a substantive financial or strategic impact on your business?

Yes

C2.3a

(C2.3a) Provide details of risks identified with the potential to have a substantive financial or strategic impact on your business.

Identifier

Risk 1

Where in the value chain does the risk driver occur?

Direct operations

Risk type & Primary climate-related risk driver

Emerging regulation Carbon pricing mechanisms

Primary potential financial impact

Increased indirect (operating) costs

CDP Page of 636

Climate risk type mapped to traditional financial services industry risk classification

<Not Applicable>

Company-specific description

The current impact of carbon pricing on PayPal is relatively minimal. However, carbon pricing mechanisms will likely be adopted by an increasing number of jurisdictions,

and the stringency of current programs will likely increase. We rely on purchased electricity for the operation of our global facilities (including data centers, offices, and

warehouses). Our global facilities consumed approximately 259,800 MWh of energy in 2022, as reported in our 2022 Global Impact Report. While our global energy use

remained relatively flat (+1% from 2021) as data center power use remained steady, office energy use increased moderately through 2022 as a result of post-pandemic

workplace repopulation. At the same time, in 2022, we reached 90% total renewable energy use (up from 88% in 2021 and 76% in 2020) and maintained 100% renewable

energy sourcing for our data centers due to an expanded approach to renewable energy procurement.

The implications of carbon pricing and increased energy costs could become more significant for PayPal over the long-term. Examples of carbon pricing schemes that could

increase our cost of energy include California’s cap-and trade-program, the EU emissions trading system, U.S. Federal carbon tax proposals, Canadian provincial

emissions policy, and emergent carbon tax policies in India and China. We continue to pursue cost-effective emissions reduction opportunities across our direct operations

and our broader value chain, such as investing in renewable energy, which will help mitigate the inherent risk presented by carbon pricing.

Time horizon

Long-term

Likelihood

Likely

Magnitude of impact

Low

Are you able to provide a potential financial impact figure?

Yes, an estimated range

Potential financial impact figure (currency)

<Not Applicable>

Potential financial impact figure – minimum (currency)

321000

Potential financial impact figure – maximum (currency)

488000

Explanation of financial impact figure

To illustrate PayPal’s potential direct exposure to carbon pricing, we utilized a simple model using 2022 Scope 1 emissions, the current floor price for California Cap & Trade

emissions allowances (illustrating a low-end carbon price) and a social cost of carbon estimate from the US EPA (illustrating a high-end carbon price). The current floor

price for California’s Cap & Trade program is $30.33, and the social cost of carbon estimate is $46.00. This model suggests direct exposure to carbon pricing via Scope 1

emissions of approximately $117,000 (3,859 metric tons CO2e * $30.33) to $178,000 (3,859 metric tons CO2e * $46). This model is limited but is illustrative of the likely

magnitude of PayPal’s direct price exposure.

Using the same methodology, our indirect exposure to carbon pricing via 2022 Scope 2 emissions from purchased electricity ranges from approximately $204,000 (6,738

metric tons CO2* $30.33) to $310,000 (6,738 metric tons CO2 * $46), assuming that carbon pricing costs are passed directly to PayPal through an electricity supplier.

Similarly, this model is limited and only serves to illustrate the potential magnitude of indirect price exposure. Based on these assumptions, we estimate potential minimum

financial impact of $321,000 ($117,000 + $204,000) and a potential maximum financial impact of $488,000 ($178,000 + $310,000).

Since PayPal’s Scope 1 and Scope 2 GHG emissions are relatively low (3,859 metric tons CO2e and 6,738 metric tons CO2e, respectively, in 2022) compared to its

revenue and market size, there is likely a low impact from carbon pricing mechanisms related to the company’s direct operations.

Cost of response to risk

201932

Description of response and explanation of cost calculation

Response: We are managing this risk by increasing the amount of renewable energy purchased and consumed in PayPal facilities. In 2022, we reached 90% total

renewable energy use and maintained 100% renewable energy sourcing for our data centers. As a result of our expanded renewable energy procurement, we further

reduced our operational GHG emissions (Scope 1 and 2) by 26% from 2021, even with our generally stable 2022 energy use, and by 80% compared to our 2019 base

year. While we observed operational GHG reductions exceeding our science-based target to reduce our operational GHG emissions by 25% by 2025, we recognize that in

future years this may change as employees return to the office and the company continues to grow.

Case Study: Situation: If we do not invest in decarbonizing our operations, we could see increased costs resulting from carbon pricing policies. Task: To mitigate our

exposure to such increased costs there are measures we can take to reduce our reliance on purchased electricity. Action: In 2021, we completed a project to add and

upgrade solar panels at our headquarters in San Jose, California, covering the rooftop of PayPal’s six-building campus. Results: These upgrades resulted in a year-over-

year purchased electricity reduction of 645,560 kWh in 2022 and estimated annual electricity procurement savings of more than $100,000. The retired solar equipment from

the original installation was donated to a local non-profit. In 2022, we enrolled in green energy tariff programs with our utility service providers in San Jose, California and

Scottsdale, Arizona, covering 100% of the electricity consumed at these sites during the year (approximately 9,800 MWh).

Cost: It is difficult to calculate the cost of responding to potential energy cost increases due to carbon pricing regimes in various markets. To do so, we estimated the annual

incremental cost to enroll in 100% green energy tariffs at our San Jose, California and Scottsdale, Arizona offices, which will help us achieve our 2025 science-based target

to reduce our absolute operational GHG emissions by 25% (from a 2019 base year). The estimated incremental cost for doing so by participating in our utility providers’

Green Energy programs at these two sites is approximately $76,000 per year. We added this figure to the annualized cost of our San Jose office solar panel upgrades of

$125,932 to reach a total of $201,932 ($76,000 + $125,932) as an estimate of the annual cost of our response.

Comment

C2.4

(C2.4) Have you identified any climate-related opportunities with the potential to have a substantive financial or strategic impact on your business?

Yes

CDP Page of 637

C2.4a

(C2.4a) Provide details of opportunities identified with the potential to have a substantive financial or strategic impact on your business.

Identifier

Opp1

Where in the value chain does the opportunity occur?

Direct operations

Opportunity type

Resilience

Primary climate-related opportunity driver

Participation in renewable energy programs and adoption of energy-efficiency measures

Primary potential financial impact

Reduced indirect (operating) costs

Company-specific description

We rely on purchased electricity for the operation of our data centers, offices, and warehouses globally and these facilities consumed approximately 259,800 MWh of

energy in 2022, as reported in our 2022 Global Impact Report. While utility expenses are not a significant component of PayPal’s indirect costs and our global energy use

remained relatively flat (+1% from 2021), we recognize the moderate increase in the energy use of our offices through 2022 as a result of post-pandemic workplace

repopulation, and the value of pursuing energy efficiency projects that meet financial and operational feasibility criteria. There are opportunities to continually optimize the

cost of maintaining our physical infrastructure through energy efficiency measures such as incorporating LED lighting as a standard for new build projects and requiring new

providers of leased data center space to incorporate renewable energy options. Additionally, procuring renewable electricity will reduce our reliance on electricity generated

from fossil fuel-based sources and our exposure to potential cost increases from carbon pricing policies which in turn will make PayPal a more resilient business. We

maintained 100% renewable energy use in our data centers in 2022, and 90% renewable energy as a percentage of our total energy use (up from 88% in 2021 and 76% in

2020). Our commitments to reach net-zero GHG emissions by 2040 and maintain 100% renewable energy use in our data centers, as well as our Science-Based Targets to

reduce our absolute operational GHG emissions by 25% by 2025 from a 2019 baseline and source 75% of our vendor spend from vendors who have set their own science-

based targets in the same timeframe, will further incentivize internal projects that realize cost and emissions savings opportunities.

Time horizon

Medium-term

Likelihood

Virtually certain

Magnitude of impact

Low

Are you able to provide a potential financial impact figure?

Yes, an estimated range

Potential financial impact figure (currency)

<Not Applicable>

Potential financial impact figure – minimum (currency)

321000

Potential financial impact figure – maximum (currency)

488000

Explanation of financial impact figure

To estimate potential cost savings from minimizing future pricing risks by increasing our renewable energy use and implementing energy efficiency initiatives, we utilized a

simple model using 2022 Scope 1 emissions, the current floor price for California Cap & Trade emissions allowances (illustrating a low-end carbon price) and a social cost of

carbon estimate from the US EPA (illustrating a high-end carbon price). The current floor price for California’s Cap & Trade program is $30.33, and the social cost of carbon

estimate is $46.00. This model suggests direct exposure to carbon pricing via Scope 1 emissions of approximately $117,000 (3,859 metric tons CO2e * $30.33) to $178,000

(3,859 metric tons CO2e * $46). This model is limited but is illustrative of the likely magnitude of PayPal’s direct price exposure.

Using the same methodology, our indirect exposure to carbon pricing via 2022 Scope 2 emissions from purchased electricity ranges from approximately $204,000 (6,738

metric tons CO2 * $30.33) to $310,000 (6,738 metric tons CO2 * $46), assuming that carbon pricing costs are passed directly to PayPal through an electricity supplier.

Similarly, this model is limited and only serves to illustrate the potential magnitude of indirect price exposure. Based on these assumptions, we estimate a potential

minimum financial impact of $321,000 ($117,000 + $204,000) and a potential maximum financial impact of $488,000 ($178,000 + $310,000).

Cost to realize opportunity

201932

Strategy to realize opportunity and explanation of cost calculation

Strategy: Renewable energy purchases and energy efficiency initiatives across our global data centers and offices help to realize opportunities to reduce energy use and,

thus, operating costs. Globally, our data center and office site managers regularly investigate efficiency opportunities. Identified projects that meet financial and operational

feasibility criteria are budgeted and implemented as part of a continuous improvement process that optimizes ongoing physical infrastructure costs.

Case Study: Situation: We set a goal in 2019 to achieve 100% renewable energy for global data center operations by 2023. Task: Having set this goal, we needed to

identify and implement ways to procure renewable energy across our portfolio of sites. Action: For example, in the U.S., in 2022, we purchased 62,423 MWh of renewable

energy through a power purchase agreement (PPA) for solar energy consumed by our facilities in Arizona. Additionally, we partner with two of our largest data center

collocation providers to procure approximately 98,000 MWh for our operations in Arizona, Nevada, and Utah. Results: As a result of our continued exploration of

opportunities to procure renewable energy for our facilities to complement ongoing energy efficiency and conservation initiatives, we’ve sourced 100% of our global data

center energy use with renewable generation since 2021. In 2022, we procured 234,820 MWh of renewable energy in total, matching 90% of our total energy use (up from

88% in 2021 and 76% in 2020) with renewable generation. In the event that carbon pricing regimes are implemented in jurisdictions where PayPal operations are located,

these strategies would likely mitigate any increases to operation costs across our global operations.

Cost: To approximate the cost to realize this opportunity, we estimated the annual incremental cost to enroll in 100% green energy tariffs at our San Jose, California and

Scottsdale, Arizona office sites, which will help us achieve our 2025 science-based target to reduce our absolute operational GHG emissions by 25% (from a 2019 base

year). The estimated incremental cost for doing so by participating in our utility providers’ Green Energy programs at these two sites is approximately $76,000 per year. We

CDP Page of 638

added this figure to the annualized cost of our San Jose office solar panel upgrades of $125,932 to reach a total of $201,932 ($76,000 + $125,932) as an estimate of the

annual cost of our response.

Comment

C3. Business Strategy

C3.1

(C3.1) Does your organization’s strategy include a climate transition plan that aligns with a 1.5°C world?

Row 1

Climate transition plan

Yes, we have a climate transition plan which aligns with a 1.5°C world

Publicly available climate transition plan

No

Mechanism by which feedback is collected from shareholders on your climate transition plan

We have a different feedback mechanism in place

Description of feedback mechanism

In 2021, we announced our goal to achieve net-zero emissions by 2040 along with medium-term science-based targets. This process was informed by direct stakeholder

feedback and engagement, including through direct consultation and a multi-stakeholder roundtable with representatives from investors, peer companies, non-profit

organizations, and supply chain partners. For example, in one-on-one conversations with multiple investors, we received support for aligning our targets to the 1.5C

pathway and Paris Agreement and the ongoing investments we are making in renewable energy procurement. We plan to continue a robust multi-stakeholder engagement

approach as we implement our low-carbon transition plan and consider future mid-term targets.

Frequency of feedback collection

Less frequently than annually

Attach any relevant documents which detail your climate transition plan (optional)

Explain why your organization does not have a climate transition plan that aligns with a 1.5°C world and any plans to develop one in the future

<Not Applicable>

Explain why climate-related risks and opportunities have not influenced your strategy

<Not Applicable>

C3.2

(C3.2) Does your organization use climate-related scenario analysis to inform its strategy?

Use of climate-related scenario

analysis to inform strategy

Primary reason why your organization does not use climate-related

scenario analysis to inform its strategy

Explain why your organization does not use climate-related scenario analysis to

inform its strategy and any plans to use it in the future

Row

1

Yes, qualitative and quantitative <Not Applicable> <Not Applicable>

C3.2a

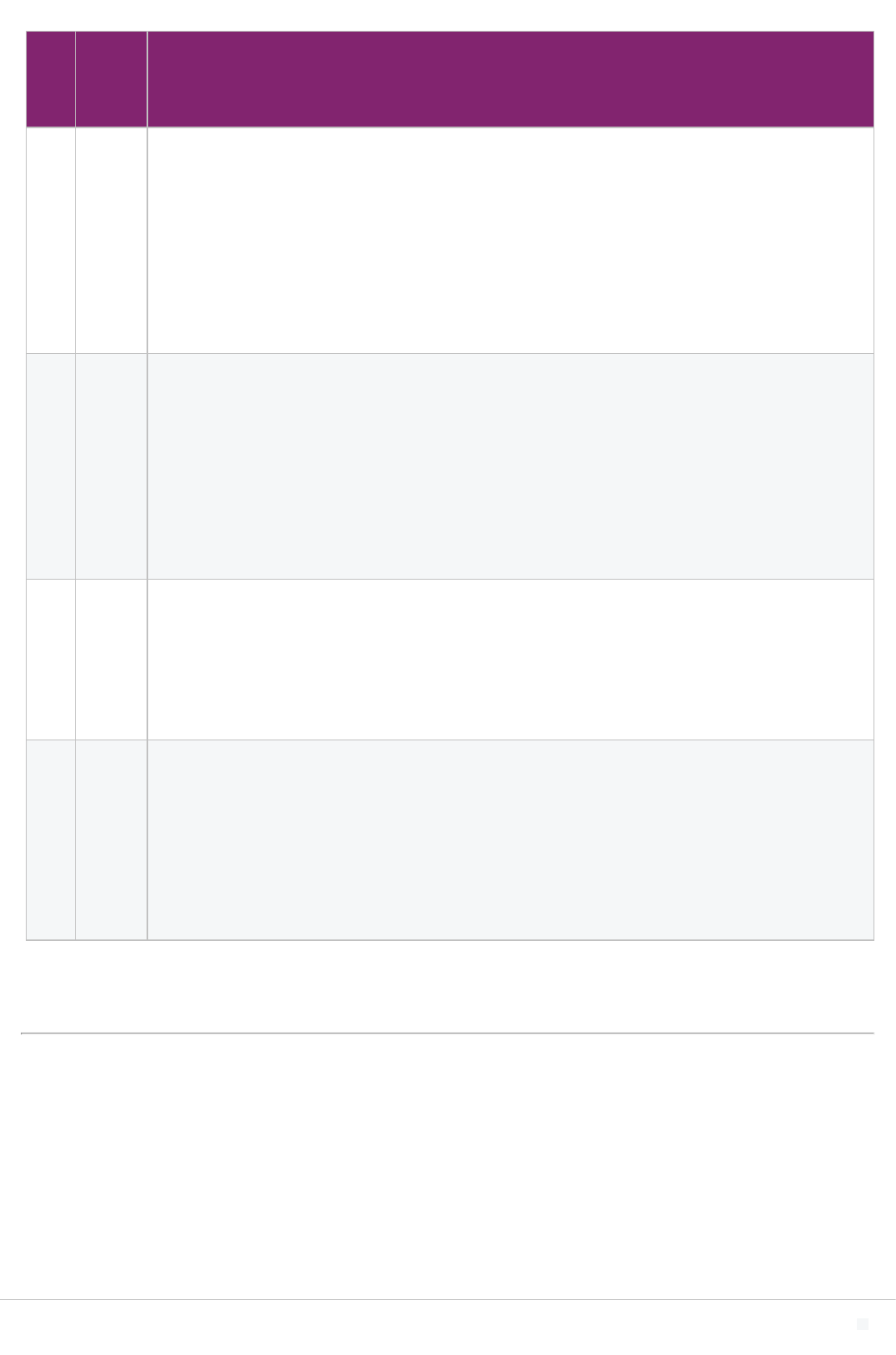

(C3.2a) Provide details of your organization’s use of climate-related scenario analysis.

Climate-

related

scenario

Scenario

analysis

coverage

Temperature

alignment of

scenario

Parameters, assumptions, analytical choices

Transition

scenarios

IEA

NZE

2050

Company-

wide

<Not

Applicable>

Beginning in 2022, we undertook climate-related scenario analysis across three potential future climate transition scenarios, including a “Net Zero emissions by 2050”

scenario that corresponds to IEA NZE 2050. Through company-wide and multi-functional internal stakeholder interviews, which were guided by our climate risk

assessment focal questions, we identified and evaluated transitional climate risks and opportunities for PayPal’s business. In the “Net Zero emissions by 2050” scenario,

the transition required drastic and coordinated global action, particularly in the 2020s. The cost of action was high but warming peaks at 1.6°C in 2050 then declines to

1.5°C by 2100.

Our initial findings indicate that this scenario presents certain transitional risks for PayPal over the short (1-3 years), medium (3-5 years), and long (more than 5 years)

term. The findings of this assessment will further inform PayPal’s management of climate risks and opportunities.

Physical

climate

scenarios

RCP

6.0

Company-

wide

<Not

Applicable>

Beginning in 2022, we undertook climate-related scenario analysis across three potential future physical climate change scenarios, including a “Current Policies” scenario

that corresponds to Representative Concentration Pathways (RCPs) 6.0. Through company-wide and multi-functional internal stakeholder interviews, which were guided

by our climate risk assessment focal questions, we identified and evaluated physical climate risks and opportunities for PayPal’s business.

Under the “Current Policies” scenario, global emissions put the world on track for at least 3.3°C of warming by 2100, with physical climate impacts increasing in severity

and frequency through 2050, including sea-level rise, desertification, extreme weather patterns, and ecosystem collapse.

Our initial findings indicate this temperature rise scenario presents certain acute and chronic physical risks for PayPal’s global operations over the short (1-3 years),

medium (3-5 years), and long (more than 5 years) term. The findings of this assessment will further inform PayPal’s management of climate risks and opportunities.

CDP Page of 639

C3.2b

(C3.2b) Provide details of the focal questions your organization seeks to address by using climate-related scenario analysis, and summarize the results with

respect to these questions.

Row 1

Focal questions

We defined the following focal questions to guide our evaluation of physical and transitional climate risks to PayPal through 2050 under each scenario, using PayPal’s

enterprise risk taxonomy and with involvement of select functional areas: (i) If PayPal's business model and strategy remain the same as it is today, what are the various

risks and opportunities facing PayPal in this scenario?; (ii) How would PayPal be performing in this scenario?; (iii) What potential risks would this scenario pose to the

company and to your specific function within PayPal?; and (iv) What potential opportunities would this scenario create for the company and to your specific function within

PayPal?

Results of the climate-related scenario analysis with respect to the focal questions

The initial results of PayPal’s climate-related scenario analysis identified key transition and physical risks for PayPal, including physical, operational, regulatory and

reputational risk. Specifically, one action taken by PayPal in relation to the focal question (iii) is the implementation of a climate risk action plan in Europe. The Europe

action plan focuses on enhancing our governance processes and risk management procedures in Europe in accordance with guidance on the management of climate-

related and environmental risks published by the Commission do Surveillance du Secteur Financier (Circular CSSF 21/773). The Europe action plan is designed to address

transition risk and physical risk exposures, as identified in relation to focus question (iii), which uncovered potential transitional risks posed by a net-zero by 2050 scenario

and potential physical risks posed by an RCP 6.0 scenario. The Europe action plan workstream commenced in 2022 and is expected to conclude before the end of 2023.

This work will enable PayPal to better meet current and emerging regulatory obligations in Europe and will inform climate risk assessments in other regions.

C3.3

CDP Page of 6310

(C3.3) Describe where and how climate-related risks and opportunities have influenced your strategy.

Have climate-

related risks

and

opportunities

influenced your

strategy in this

area?

Description of influence

Products

and

services

Yes We see opportunities for our digital payments technology to help build climate resilience and foster opportunities across the global economy over the short-, medium-, and long-term.

We also recognize the opportunity to further our financial health mission by establishing long-term science-based commitments and supporting digital finance solutions for climate

resilience. In addition, we see the potential for climate innovation to enhance the customer value proposition of our products and services.

PayPal’s digital payment products can help enable effective and timely financial responses to climate-influenced natural disasters. Our rapid response fundraising team actively

monitors global events, including extreme weather activity, and evaluates our ability to mobilize our users and leverage our fundraising capabilities. Where response and recovery

needs align with our capabilities, we endeavor to launch campaigns to aid in the delivery of relief efforts to impacted communities facing climate-influenced disasters. In 2022, we

helped concerned individuals donate more than $1 million to responding charities in the wake of deadly flooding in Pakistan and Hurricane Ian in Florida, U.S. We also helped people

in Mississippi, U.S. through corporate donations to two charities working in the community to provide relief and build capacity following water outages triggered by severe flooding

events.

We are in the early phases of researching the potential of digital climate finance solutions, which will require significant research and development to deliver at scale. PayPal is a

founding member of the Climate Innovation for Adaptation and Resilience (CIFAR) Alliance, a global initiative working to provide climate adaptation and resilience tools and resources

to one billion of the world’s most vulnerable people.

We also continue to invest in climate impact projects that promote climate transition opportunities for those with limited means . In 2022, PayPal invested in carbon credit projects in

India, Guatemala, and Mexico.

Supply

chain

and/or

value

chain

Yes We annually update our screening of Scope 3 emissions categories and estimated indirect emissions in our supply chain from purchased goods and services, capital goods, and

upstream transportation and distribution. We also annually measure business travel emissions using activity data for air travel, rail, rental cars, and hotels and for fuel and energy

related activities, which includes estimates based on Scope 2 data center emissions from IT infrastructure energy use under PayPal operational control. Since 2021, we have reported

our Scope 3 emissions for all relevant Scope 3 categories across PayPal’s value chain.

Scope 3 emissions and the value chain risks stemming from not effectively managing our Scope 3 emissions, such as the risk of rising procurement costs, are relevant to PayPal in

the short-, medium-, and long-term. Emerging carbon regulation could lead to rising fuel prices and increasing energy costs for our vendors, resulting in higher operating costs to their

business and higher prices for the goods and services that we procure such as IT hardware.

We set a Science-Based Target to have 75% of our vendors by spend set their own science-based targets by 2025. In 2021, with support from CDP Supply Chain, we implemented a

vendor climate engagement program to help our suppliers manage their science-based climate action efforts. As of year-end 2022, 39% of our vendors by spend within the relevant

Scope 3 categories have set science-based targets, up from 30% in 2021 and 27% in 2020. We have restated prior period values based on refinements in assessment methodology

to include vendor spend from relevant Scope 3 categories only.

In addition, vendors are required to comply with PayPal’s publicly available Third-Party Code of Conduct & Ethics or provide their own contractual obligations affirming they will

develop and implement environmental responsible business practices to reduce PayPal’s environmental impact and prioritize reducing, or eliminating GHG emissions, energy, input

materials and waste.

Investment

in R&D

Yes Innovation is a strategic dimension of our approach to environmental sustainability and climate action and a core company value. Our cross-functional Environmental Working Group

collaborates closely with PayPal’s Innovation Lab to identify and invest in ideas to manage our climate impact, inspire employee innovation, and empower consumers and

communities to address climate change.

We believe that blockchain technology has the potential to deliver innovative, positive social impact. In 2021, we consulted with climate accounting experts, academics, investors, and

blockchain industry stakeholders to assess the climate impacts associated with crypto assets and contribute to emerging best practices in climate accounting measurement. In 2022,

we estimated cryptocurrency-related emissions using calendar year activity data and the Hybrid Emissions Allocation Method as presented in the Accounting for Cryptocurrency

Climate Impacts guidance published by Crypto Carbon Rating Institute and South Pole in 2022. We support efforts to develop GHG emissions accounting guidance that is consistent

with recognized and widely adopted accounting frameworks.

In addition, we are also exploring climate mitigation strategies consistent with our net-zero goal and Science-Based Targets. These include opportunities to invest in product

innovations, engage with custodians and service providers, and fund climate impact projects that help to enable climate resilience.

Operations Yes PayPal’s climate action strategy prioritizes reduction of Scope 1 and 2 GHG emissions within our operations over the short-, medium-, and long-term. Operational efficiency presents

climate-related opportunities and mitigates risk. We annually measure and report operational emissions from our facilities globally. In 2022, our global energy remained relatively flat

(+1% from 2021) as data center power use remained steady and office energy use increased moderately as a result of post-pandemic workplace repopulation. At the same time, we

reached 90% total renewable energy use and maintained 100% renewable energy sourcing for our data centers. Our expanded approach to renewable energy procurement helped to

further reduce our Scope 1 and 2 emissions by 26% from 2021, even with our generally stable 2022 energy use, and by 80% compared to our 2019 base year.

Renewable energy and energy management are integrated within the operational strategies for our data center and real estate and facilities teams. Since 2021, we have maintained

100% renewable energy procurement for our data centers. 77% of our global energy use as of 2022 is attributable to our data centers and is a primary driver of our GHG emissions.

In addition, we have increased renewable energy sourcing for our offices. Renewable energy purchases and intelligent energy management practices across our data centers and

global real estate portfolio help mitigate risk associated with energy price fluctuations and evolving regulations while improving overall corporate efficiency.

While most of our computing occurs at PayPal data centers, we continue to migrate to cloud service providers who either have or are committed to achieving 100% renewable energy.

This transition supports both improvements in computing and storage efficiency, as well as energy consumption.

We believe there is a reasonable likelihood of continued operational emissions reductions as we execute against our operational strategy.

C3.4

CDP Page of 6311

(C3.4) Describe where and how climate-related risks and opportunities have influenced your financial planning.

Financial

planning

elements

that have

been

influenced

Description of influence

Row

1

Indirect

costs

Climate risks and opportunities are relevant to, and incorporated in, our indirect cost planning over the short-, medium-, and long-term. This is demonstrated by our financial planning for

renewable energy procurement. In 2019, PayPal committed to matching 100% of the energy used by its data centers with renewable energy generation by 2023 and has achieved this objective

since 2021. As a result, our financial planning for data center energy expenses reflects the costs of procuring renewable energy. Energy use in data centers is attributable to associated

operations as well as cooling. As global temperatures increase, energy related to cooling data centers may also increase.

While near term energy costs may increase due to a premium for “green power,” the long-term nature of power purchase agreements (PPA) may result in lower energy cost over the life of the

agreement, relative to traditional energy generation sources. For example, a PPA signed in 2017 that provides renewable electricity to facilities in Arizona required a 20-year financial

commitment. This long-term contract will result in stable energy costs compared to the purchase of a comparable amount of energy through traditional commercial electricity tariffs. The long-term

contract also provides predictability and may result in lower future cost for renewable energy credits (RECs) used to meet our data center renewable energy commitment. We purchased 62,423

MWh of renewable energy through this PPA in 2022. We continue to focus on renewable energy procurement for our global facilities (including data centers, offices, and warehouses), matching

58% of the energy used with renewable generation as of 2022 (compared to 40% in 2021 and 11% in 2020). Given uncertainty with respect to renewable energy prices and markets, PayPal will

continue to reassess financial planning for data center and office energy to prioritize low-cost and emissions-free energy resources.

To further prioritize low-carbon energy sources in our leased spaces, we have added a sustainability assessment to our standard leasing practice to evaluate factors such as renewable energy

access and efficiency standards for all prospective office locations.

C3.5

(C3.5) In your organization’s financial accounting, do you identify spending/revenue that is aligned with your organization’s climate transition?

Identification of spending/revenue that is aligned with your organization’s climate

transition

Indicate the level at which you identify the alignment of your spending/revenue with a sustainable finance

taxonomy

Row

1

No, but we plan to in the next two years <Not Applicable>

C4. Targets and performance

C4.1

(C4.1) Did you have an emissions target that was active in the reporting year?

Absolute target

C4.1a

(C4.1a) Provide details of your absolute emissions target(s) and progress made against those targets.

Target reference number

Abs 1

Is this a science-based target?

Yes, and this target has been approved by the Science Based Targets initiative

Target ambition

1.5°C aligned

Year target was set

2020

Target coverage

Company-wide

Scope(s)

Scope 1

Scope 2

Scope 2 accounting method

Market-based

Scope 3 category(ies)

<Not Applicable>

Base year

2019

Base year Scope 1 emissions covered by target (metric tons CO2e)

6509

Base year Scope 2 emissions covered by target (metric tons CO2e)

CDP Page of 6312

46643

Base year Scope 3, Category 1: Purchased goods and services emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 2: Capital goods emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 4: Upstream transportation and distribution emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 5: Waste generated in operations emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 6: Business travel emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 7: Employee commuting emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 8: Upstream leased assets emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 9: Downstream transportation and distribution emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 10: Processing of sold products emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 11: Use of sold products emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 12: End-of-life treatment of sold products emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 13: Downstream leased assets emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 14: Franchises emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 15: Investments emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Other (upstream) emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Other (downstream) emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year total Scope 3 emissions covered by target (metric tons CO2e)

<Not Applicable>

Total base year emissions covered by target in all selected Scopes (metric tons CO2e)

53152

Base year Scope 1 emissions covered by target as % of total base year emissions in Scope 1

100

Base year Scope 2 emissions covered by target as % of total base year emissions in Scope 2

100

Base year Scope 3, Category 1: Purchased goods and services emissions covered by target as % of total base year emissions in Scope 3, Category 1:

Purchased goods and services (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 2: Capital goods emissions covered by target as % of total base year emissions in Scope 3, Category 2: Capital goods (metric

tons CO2e)

<Not Applicable>

Base year Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) emissions covered by target as % of total base year

emissions in Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 4: Upstream transportation and distribution covered by target as % of total base year emissions in Scope 3, Category 4: Upstream

transportation and distribution (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 5: Waste generated in operations emissions covered by target as % of total base year emissions in Scope 3, Category 5: Waste

generated in operations (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 6: Business travel emissions covered by target as % of total base year emissions in Scope 3, Category 6: Business travel (metric

tons CO2e)

<Not Applicable>

Base year Scope 3, Category 7: Employee commuting covered by target as % of total base year emissions in Scope 3, Category 7: Employee commuting

(metric tons CO2e)

CDP Page of 6313

<Not Applicable>

Base year Scope 3, Category 8: Upstream leased assets emissions covered by target as % of total base year emissions in Scope 3, Category 8: Upstream

leased assets (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 9: Downstream transportation and distribution emissions covered by target as % of total base year emissions in Scope 3,

Category 9: Downstream transportation and distribution (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 10: Processing of sold products emissions covered by target as % of total base year emissions in Scope 3, Category 10:

Processing of sold products (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 11: Use of sold products emissions covered by target as % of total base year emissions in Scope 3, Category 11: Use of sold

products (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 12: End-of-life treatment of sold products emissions covered by target as % of total base year emissions in Scope 3, Category 12:

End-of-life treatment of sold products (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 13: Downstream leased assets emissions covered by target as % of total base year emissions in Scope 3, Category 13:

Downstream leased assets (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 14: Franchises emissions covered by target as % of total base year emissions in Scope 3, Category 14: Franchises (metric tons

CO2e)

<Not Applicable>

Base year Scope 3, Category 15: Investments emissions covered by target as % of total base year emissions in Scope 3, Category 15: Investments (metric tons

CO2e)

<Not Applicable>

Base year Scope 3, Other (upstream) emissions covered by target as % of total base year emissions in Scope 3, Other (upstream) (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Other (downstream) emissions covered by target as % of total base year emissions in Scope 3, Other (downstream) (metric tons CO2e)

<Not Applicable>

Base year total Scope 3 emissions covered by target as % of total base year emissions in Scope 3 (in all Scope 3 categories)

<Not Applicable>

Base year emissions covered by target in all selected Scopes as % of total base year emissions in all selected Scopes

100

Target year

2025

Targeted reduction from base year (%)

25

Total emissions in target year covered by target in all selected Scopes (metric tons CO2e) [auto-calculated]

39864

Scope 1 emissions in reporting year covered by target (metric tons CO2e)

3859

Scope 2 emissions in reporting year covered by target (metric tons CO2e)

6738

Scope 3, Category 1: Purchased goods and services emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 2: Capital goods emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 4: Upstream transportation and distribution emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 5: Waste generated in operations emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 6: Business travel emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 7: Employee commuting emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 8: Upstream leased assets emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 9: Downstream transportation and distribution emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 10: Processing of sold products emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

CDP Page of 6314

Scope 3, Category 11: Use of sold products emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 12: End-of-life treatment of sold products emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 13: Downstream leased assets emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 14: Franchises emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Category 15: Investments emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Other (upstream) emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Scope 3, Other (downstream) emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Total Scope 3 emissions in reporting year covered by target (metric tons CO2e)

<Not Applicable>

Total emissions in reporting year covered by target in all selected scopes (metric tons CO2e)

10597

Does this target cover any land-related emissions?

No, it does not cover any land-related emissions (e.g. non-FLAG SBT)

% of target achieved relative to base year [auto-calculated]

320.251354605659

Target status in reporting year

Underway

Please explain target coverage and identify any exclusions

We are committed to addressing our emissions and supporting climate action to meet the Paris Climate Agreement. We set a Science-Based Target to reduce absolute

Scope 1 and 2 GHG emissions 25% by 2025 from a 2019 base year. This target covers 100% of Scope 1 and Scope 2 emissions arising from our direct operational

activities, with no exclusions.

Plan for achieving target, and progress made to the end of the reporting year

We remain steadfast in our commitment to reducing Scope 1 and 2 emissions consistent with our Science-Based Target and are working to expand renewable energy

sourcing and energy efficiency initiatives for our offices and maintaining 100% renewable energy commitment for data centers. Our 2022 Scope 1 and Scope 2 GHG

emissions were lower compared to 2019 primarily driven by the substantial growth of our data center renewable energy procurement, which reached 100% in 2021, and the

significant reduction of office energy use due to COVID-19. While we remain on track to meet our Science-Based Target by 2025 and observed Scope 1 and 2 GHG

emissions reductions exceeding our 2025 goal in 2022, we may experience incremental Scope 1 and 2 GHG emissions increases in the near-term from a return to in-office

working and company growth.

List the emissions reduction initiatives which contributed most to achieving this target

<Not Applicable>

Target reference number

Abs 2

Is this a science-based target?

Yes, and this target has been approved by the Science Based Targets initiative

Target ambition

1.5°C aligned

Year target was set

2020

Target coverage

Company-wide

Scope(s)

Scope 3

Scope 2 accounting method

<Not Applicable>

Scope 3 category(ies)

Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2)

Base year

2019

Base year Scope 1 emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 2 emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 1: Purchased goods and services emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 2: Capital goods emissions covered by target (metric tons CO2e)

<Not Applicable>

CDP Page of 6315

Base year Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) emissions covered by target (metric tons CO2e)

27400

Base year Scope 3, Category 4: Upstream transportation and distribution emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 5: Waste generated in operations emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 6: Business travel emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 7: Employee commuting emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 8: Upstream leased assets emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 9: Downstream transportation and distribution emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 10: Processing of sold products emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 11: Use of sold products emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 12: End-of-life treatment of sold products emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 13: Downstream leased assets emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 14: Franchises emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 15: Investments emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Other (upstream) emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Other (downstream) emissions covered by target (metric tons CO2e)

<Not Applicable>

Base year total Scope 3 emissions covered by target (metric tons CO2e)

27400

Total base year emissions covered by target in all selected Scopes (metric tons CO2e)

27400

Base year Scope 1 emissions covered by target as % of total base year emissions in Scope 1

<Not Applicable>

Base year Scope 2 emissions covered by target as % of total base year emissions in Scope 2

<Not Applicable>

Base year Scope 3, Category 1: Purchased goods and services emissions covered by target as % of total base year emissions in Scope 3, Category 1:

Purchased goods and services (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 2: Capital goods emissions covered by target as % of total base year emissions in Scope 3, Category 2: Capital goods (metric

tons CO2e)

<Not Applicable>

Base year Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) emissions covered by target as % of total base year

emissions in Scope 3, Category 3: Fuel-and-energy-related activities (not included in Scopes 1 or 2) (metric tons CO2e)

100

Base year Scope 3, Category 4: Upstream transportation and distribution covered by target as % of total base year emissions in Scope 3, Category 4: Upstream

transportation and distribution (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 5: Waste generated in operations emissions covered by target as % of total base year emissions in Scope 3, Category 5: Waste

generated in operations (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 6: Business travel emissions covered by target as % of total base year emissions in Scope 3, Category 6: Business travel (metric

tons CO2e)

<Not Applicable>

Base year Scope 3, Category 7: Employee commuting covered by target as % of total base year emissions in Scope 3, Category 7: Employee commuting

(metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 8: Upstream leased assets emissions covered by target as % of total base year emissions in Scope 3, Category 8: Upstream

leased assets (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 9: Downstream transportation and distribution emissions covered by target as % of total base year emissions in Scope 3,

Category 9: Downstream transportation and distribution (metric tons CO2e)

CDP Page of 6316

<Not Applicable>

Base year Scope 3, Category 10: Processing of sold products emissions covered by target as % of total base year emissions in Scope 3, Category 10:

Processing of sold products (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 11: Use of sold products emissions covered by target as % of total base year emissions in Scope 3, Category 11: Use of sold

products (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 12: End-of-life treatment of sold products emissions covered by target as % of total base year emissions in Scope 3, Category 12:

End-of-life treatment of sold products (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 13: Downstream leased assets emissions covered by target as % of total base year emissions in Scope 3, Category 13:

Downstream leased assets (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Category 14: Franchises emissions covered by target as % of total base year emissions in Scope 3, Category 14: Franchises (metric tons

CO2e)

<Not Applicable>

Base year Scope 3, Category 15: Investments emissions covered by target as % of total base year emissions in Scope 3, Category 15: Investments (metric tons

CO2e)

<Not Applicable>

Base year Scope 3, Other (upstream) emissions covered by target as % of total base year emissions in Scope 3, Other (upstream) (metric tons CO2e)

<Not Applicable>

Base year Scope 3, Other (downstream) emissions covered by target as % of total base year emissions in Scope 3, Other (downstream) (metric tons CO2e)

<Not Applicable>

Base year total Scope 3 emissions covered by target as % of total base year emissions in Scope 3 (in all Scope 3 categories)

1.8

Base year emissions covered by target in all selected Scopes as % of total base year emissions in all selected Scopes

1.8

Target year

2025

Targeted reduction from base year (%)

25

Total emissions in target year covered by target in all selected Scopes (metric tons CO2e) [auto-calculated]

20550