Cashback Terms & Conditions – FLIPKART AXIS BANK Credit Card

Definitions: For the Flipkart Axis Bank Credit Card, the following terms shall, unless the context otherwise

admits, shall have the following meanings:

Cashback shall mean money awarded in the customer’s credit card account under the cashback

scheme.

Preferred Merchants shall include certain merchants on which the cashback earnings shall be 4%.

These merchants can change at the bank’s discretion.

The cashback will be processed according to the following table:

Spends on

Cashback

Flipkart* and Cleartrip

5%

Preferred Merchants**

4%

Other eligible merchants

1%

* Valid on the website as well as mobile application of Flipkart excluding Flipkart Health

** Preferred merchants and their respective offers are subject to change from time to time without any

prior notice.

Cashback shall not be eligible for following spends/transactions on the card - fuel spends , purchase

of gift cards on Flipkart & Myntra, EMI transactions , purchases converted to EMI post-facto, wallet

loading transactions ,purchase of jewelry items , insurance services, utilities, educational services,

payments towards government services, cash advances, rental payments, payment of outstanding

balances, payment of card fees and other card charges.

Please note that only transactions made towards Food Delivery on Swiggy App shall be eligible for

accelerated cashback. Transactions made on ‘Instamart’,’ genie’ etc. shall not be eligible for

accelerated cashback.

For eg. If the customer spends Rs. 50,000 in a billing cycle with the following break up of spends –

o Flipkart: Rs. 10,000 | Preferred Merchants: Rs. 5,000 | Other spends: Rs. 35,000

o Out of these “Other spends”, Rs. 10,000 was an EMI purchase.

o Thus, the total spends eligible for cashback would only be Rs. 10,000 + Rs. 5,000 + Rs. 35,000 – Rs.

10,000 (EMI transaction) = Rs. 40,000

The cashback for the billing cycle in example would be calculated as follows:

5% of Rs. 10,000 = Rs. 500

4% of Rs. 5,000 = Rs. 200

1% of Rs. 25,000 = Rs. 250

Thus, the total cashback for the example would be Rs. 500+200+250 = Rs. 950

Non-customer initiated payment/credit such as Merchant refund/cashback/charge reversals etc.

received into the credit card account will not be considered as a payment towards the outstanding

of the card. However, such credits will be considered to compute the subsequent month’s dues.

Cashback earned for the purchases during the current billing cycle will be credited in the next billing

cycle 3 days prior to the statement generation date i.e. if the statement date is 15

th

March, cashback

earned in the Feb month cycle (16

th

Jan-15

th

Feb) will be credited on 12

th

March.

Cashback earned will be computed based on spends during the statement period minus any returns

or refunds during the same period.

In case the purchase/ transaction is returned/ cancelled/ reversed post statement generation date,

cashback toward such transactions will be debited on the date of such purchase/ transaction reversal.

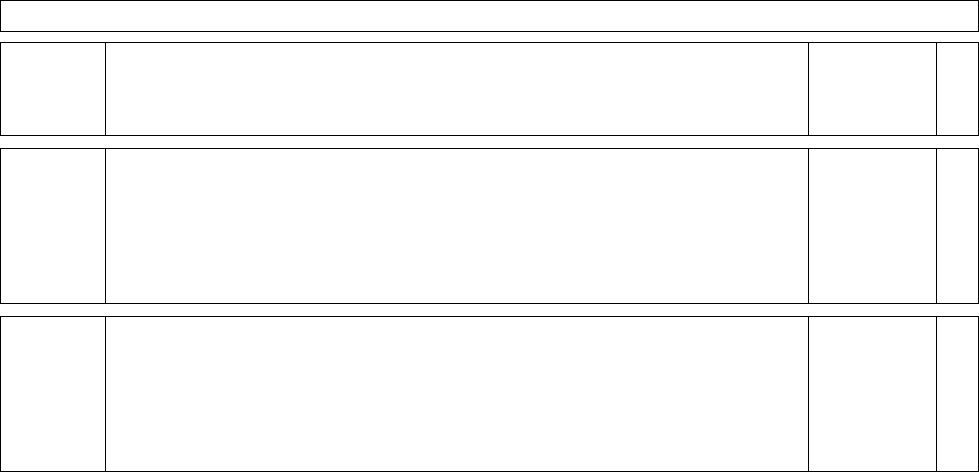

Statement Period: 16

th

of a month to 15

th

of the next month

Cashback

Credit

Purchase on Flipkart on 10

th

Jan

Rs. 1000

Dr

Cashback earned in the Jan cycle with statement date of 15

th

Jan

Rs. 50

Cashback credited 3 days prior to next statement date i.e. on 12

th

Feb

Rs. 50

Cr

Cashback

Credit -

Return in

same

cycle

Purchase on Myntra on 5

th

Jan

Rs. 10000

Dr

Partial Return of Myntra purchase on 10

th

Jan

Rs. 1000

Cr

Cashback return for cancelled transaction on 10

th

Jan

Rs. 10

Cashback earned in the Jan cycle with statement date of 15

th

Jan

Rs. 500

Cashback credited 3 days prior to next statement date i.e. on 12

th

Feb

Rs. 490

Cr

Cashback

Credit -

Return in

next

cycle

Purchase on Myntra on 5th Jan

Rs. 10000

Dr

Cashback earned in the Jan cycle with statement date of 15th Jan

Rs. 100

Cashback credited 3 days prior to next statement date i.e. on 12th Feb

Rs. 100

Cr

Partial Return of Myntra purchase on 20th Jan

Rs. 1000

Cr

Cashback return for cancelled transaction on 20th Jan - posted on 12th Feb

Rs. 10

Dr

In case of conversion of a transaction to EMI at a later date, cashback earned on such transaction will

be reversed during the same billing cycle as EMI conversion.

The cashbacks earned/reversed during a billing cycle will be visible in the monthly credit card billing

statement.

In case the customer reverses a transaction, the corresponding cashback earned on the transaction

will also be reversed and in case the customer has an outstanding balance on credit card in the form

of reversed cashback, the same will be treated as an ordinary outstanding balance and the customer

will be liable to pay for such outstanding amount, failing which the said amount will attract the fees

& charges as per the schedule of charges defined in the Most Important Terms and Conditions.

There is no limit on earnings of cashback on the credit card.

If a Cardholder's Flipkart Axis Bank credit card is terminated at any time for any reason, whether by

the primary Cardholder or the Bank, the primary Cardholder will forthwith be disqualified from

earning the Cash backs and all unused Cash backs then accrued shall automatically be forfeited

immediately after voluntary or involuntary cancellation of the Flipkart Axis Bank Credit Card.

Any remaining cashback including cashbacks pending credit into the account of the Cardholder shall

immediately cease to be valid upon the occurrence of the following:

The cancellation of the Flipkart Axis Bank credit card; or

The conversion of the Flipkart Axis Bank Credit Card to any other Axis Bank credit card

In the event of a default i.e. if the Minimum Amount Due is not paid by the Payment Due Date

or

Breach of any clause of the Card Member Agreement

And no refund, extension or compensation shall be given by Axis Bank even if the card member’s

membership is reinstated.

The Credit Card is issued for personal expenses and purposes only. The Cardholder must not use the

Credit Card to purchase anything for resale, for commercial or business purposes. The Credit Card

should be used only for lawful, bona fide personal purposes and must not be used for any money

laundering, anti-social or speculative activities or must not be exploited commercially in business

(e.g. for working capital purposes).

If the Credit Card is found to be used for prohibited, restricted, commercial purposes or any purposes

as mentioned above, Axis Bank may, at its sole discretion, exercise its right to cancel the concerned

Credit Card and additional/add-on cards thereof and withhold/cancel the Cashback earned, without

any notice to the Cardholder. Axis Bank may enquire with you over phone or through any other

means of formal communication and seek details, information, proofs, etc., about the Credit Card

transactions, pattern of usage, etc. Non- satisfactory responses or no responses from the Cardholder

may lead to blocking/closure of the Credit Card by Axis Bank

Use of the Card at Merchant Establishment will be limited by the credit limit assigned to each Card

Account by the Bank.

The Bank may, at any time without prior notice, or stating any reason whatsoever, refuse

authorization for a Charge at a Merchant Establishment, and / or restrict or defer the Card member's

ability to use the Card and / or suspend or cancel the Card. The Bank through the ATM, Merchant

Establishment, by itself may repossess / retain the Credit Card, if it reasonably believes that it is

necessary to do so for proper management of credit or business risk, or if the Card or Card Account

is being misused or likely to be misused.

Nothing contained in the cashback proposition shall be construed as a binding obligation on Axis Bank

or any participating Merchant Partner to continue the Cashback Scheme after the Scheme

Termination Date or to substitute the Cashback Scheme by a new or similar scheme.

Cashback is not applicable on transactions less than Rs. 100.

The bank may temporarily prohibit any customer from earning cashback or using any features of the

program.

For customers who want to cancel their EMI transactions, customers need to call up Axis Bank

customer care at 18604195555/18605005555 for the same.

For EMI transactions that are cancelled by the customer/bank, the cashback in the customer’s

statement for that respective cycle might get debited twice, the customer would need to raise a

service request by calling the Axis Bank customer care mentioning that cashback has been incorrectly

debited with the date and amount of transaction for correction of the same.

Since there is no cashback on EMI transactions, once a transaction is converted in to EMI, the

customer will not earn any cashback on the transaction even if the customer opts for foreclosure or

cancellation of the EMI and pays the full amount on the same.

For customers who wish to foreclose their EMI transactions, customers would need to call up Axis

Bank customer care and place a request for the same.

The cashback will be rounded down for each individual transaction. For eg., If for a transaction of Rs.

1180, the customer is eligible for a cashback of 1% i.e., 1180 * 1% = Rs. 11.8. Only Rs. 11 will be

credited to the customer for that individual transaction.

Axis Bank will send e-statements as per the details updated in Bank’s records. Non receipt of

statement would not impact the obligation and liability for the customer under this agreement and

shall be liable to settle the outstanding balance on the card within the payment due date.

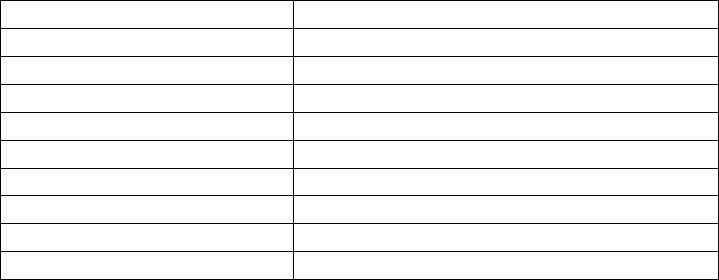

The following MCCs have been excluded from cashback eligibility –

MCCs Excluded

Description

4814, 4816, 4899, 4900

Utility Services

5541, 5542, 5983

Fuel

5944

Clock, Jewelry, Watch and Silverware Stores

5960, 6300, 6381

Insurance Services

6011, 6012, 6051

Financial Institutions

6513

Rental Payments

6540

Wallet Load Transactions

8211, 8241, 8244, 8249, 8299

Educational Services

9399

Government Services

Cashback of 5% and 4% categories (Accelerated Cashback) will be calculated basis the Merchant IDs

(MIDs) shared by the respective merchants. Axis Bank shall not be held liable if a transaction on any

of these merchants does not earn accelerated cashback.

W.e.f 15

th

Feb 2024, TataPlay will not be considered as a preferred merchant for Flipkart Axis Bank

Credit Card. This means that all the eligible transactions done on TataPlay using the Flipkart Axis Bank

Credit Card on or after 15

th

Feb 2024 will earn base cashback of 1% only.

The terms and conditions mentioned in the document can be revised or terminated at any time with

30 days prior notice.

The cashback shall not be applicable if the Card has been withdrawn or cancelled or is liable to be

cancelled or the account of the Card member is a delinquent Account.

Axis Bank’s computation of the Cashback shall be final, conclusive and binding on a Card member and

will not be liable to be disputed or questioned.

The terms contained in this document shall be in addition to and not in derogation of the Most

Important Terms and Conditions document.

The cashback proposition is made available at the pleasure of Axis Bank and Axis Bank expressly

reserves the right at any time and with notice to Card members, to add to and/or alter, modify,

change or vary all or any of these Terms and Conditions or to replace wholly or in part, the Cashback

Scheme by another scheme, or to withdraw it altogether.

Without prejudice to anything contained in the Terms and Conditions, all disputes, if any, arising out

of or in connection with or as a result of the Rewards Scheme or otherwise relating hereto shall be

subject to the exclusive jurisdiction of the competent courts / tribunals at Mumbai.